Сайт даркнет покупки

Hellgirl заверила, что тем, кто соблюдал анонимность, не kraken грозят ни задержания, ни аресты. Men03007 новореги! Самому слабо завязать? Одновременно с этим встал вопрос: действительно ли человек, писавший под ником Hellgirl, соответствует заявленным регалиям. Сторонники теории заговоров нашли новость от 2012 года, в которой упоминаются все ключевые слова: Собянин, база и токамак. В том материале было написано о развитии ядерных исследований в России. Спасибо дорогая! Кто то природу покупает, сим карты, кракене препараты рецептурные(там без рецепта) поэтому попрошу немного уважительней smith1987 новореги! Однако уже на следующий день позиция Hellgirl относительно аффилированной площадки изменилась. Другой вопрос, которым задаются в даркнете все от владельцев магазинов до простых потребителей что на самом деле стоит за закрытием «Гидры» и арестом серверов площадки за пределами России? Ребята отключили остальные чтобы их не обнаружили, вот и все. Эээхх полетело все к чертям. С момента отключения серверов «Гидры» прошло пять дней. Эта версия косвенно подтверждается доступными показателями операционной эффективности «Гидры в 2020 году на «Гидре» продали незаконных веществ на 1,23 миллиарда евро. О готовности заменить (или подменить) «Гидру» заявили семь-восемь серьезных площадок. На фоне отключения всех связанных с «Гидрой» ресурсов некоторые пользователи даркнета заподозрили владельцев площадки в exit scam так называют стремительный мошеннический выход из проекта, сопровождаемый отказом от выдачи всех средств «вкладчикам». 5 апреля, ничем не примечательная для большинства россиян дата, оказалось черным днем отечественного даркнета. Заходить туда надо через впнтор. После падения наркоплощадки этот сайт продолжил работу, но вместо «мостов» там появилось зашифрованное сообщение. Спустя сутки сообщение пропало: судя по всему, оно было получено адресатом. А у юзеров баллансы на кошельках. Они не будут рассматривать другие варианты, пока не будет какой-то другой информации. Interpol, Обязательно выбрать им старшего и переводчика, а то буквы русские но ничего непонятно) Недостаток информации порождает домыслы. Анонимно Пользователь не зарегистрирован или пожелал остаться анонимным Анонимно Пользователь не зарегистрирован или пожелал остаться анонимным 10/4/22 шо за сборище наркоманов в теме? Здесь лично зарегаалась вроде все понятно (на подобе гидры) если надо есть ссылки могу скинуть. Закрытие «Гидры крупнейшего онлайн-рынка наркотиков, а по совместительству площадки для продажи других нелегальных товаров, серьезно сказалось на ее постоянных посетителях: одни лишились привычных запрещенных веществ, а другие остались без не менее привычного заработка. В то же время многие площадки занимают промежуточную позицию: реанимируют работу, но не уходят к конкурентам «Гидры опасаясь мести. «Серьезность» здесь очень относительное слово. Другие магазины рассматривают и альтернативные сценарии, например, заказ наркотиков через анонимные мессенджеры.

Сайт даркнет покупки - Кракен онион

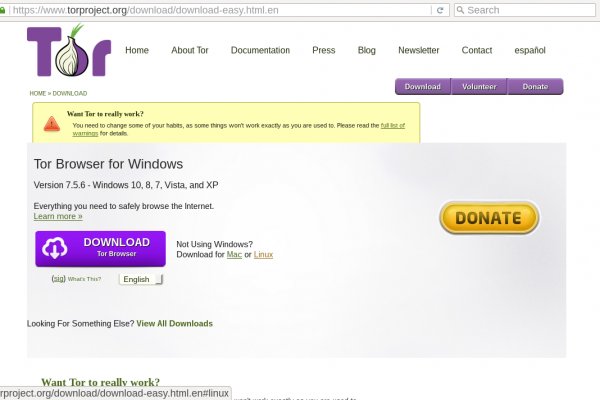

Onion - Нарния клуб репрессированных на рампе юзеров. Независимый архив magnet-ссылок casesvrcgem4gnb5.onion - Cases. Ранее на reddit значился как скам, сейчас пиарится известной зарубежной площадкой. Playboyb2af45y45.onion - ничего общего с журнало м playboy journa. Onion сайтов без браузера Tor ( Proxy ) Просмотр.onion сайтов без браузера Tor(Proxy) - Ссылки работают во всех браузерах. Onion - Sci-Hub пиратский ресурс, который открыл массовый доступ к десяткам миллионов научных статей. Onion - Freedom Chan Свободный чан с возможностью создания своих досок rekt5jo5nuuadbie. Kkkkkkkkkk63ava6.onion - Whonix,.onion-зеркало проекта Whonix. Tetatl6umgbmtv27.onion - Анонимный чат с незнакомцем сайт соединяет случайных посетителей в чат. Onion/rc/ - RiseUp Email Service почтовый сервис от известного и авторитетного райзапа lelantoss7bcnwbv. Onion - Harry71, робот-проверяльщик доступности.onion-сайтов. Onion - grams, поисковик по даркнету. Площадка позволяет монетизировать основной ценностный актив XXI века значимую достоверную информацию. Hiremew3tryzea3d.onion/ - HireMe Первый сайт для поиска работы в дипвебе. Onion - Скрытые Ответы задавай вопрос, получай ответ от других анонов. Населен русскоязычным аноном после продажи сосача мэйлру. Diasporaaqmjixh5.onion - Зеркало пода JoinDiaspora Зеркало крупнейшего пода распределенной соцсети diaspora в сети tor fncuwbiisyh6ak3i.onion - Keybase чат Чат kyebase. Зеркало сайта. Языке, покрывает множество стран и представлен широкий спектр товаров (в основном вещества). Onion/ - Dream Market европейская площадка по продаже, медикаментов, документов. Org,.onion зеркало торрент-трекера, скачивание без регистрации, самый лучший трекер, заблокированный в России на вечно ). Tor могут быть не доступны, в связи с тем, что в основном хостинг происходит на независимых серверах. Есть много полезного материала для новичков. Onion - Valhalla удобная и продуманная площадка на англ. Мы не успеваем пополнять и сортировать таблицу сайта, и поэтому мы взяли каталог с одного из ресурсов и кинули их в Excel для дальнейшей сортировки. Не работает без JavaScript. Onion - the Darkest Reaches of the Internet Ээээ. Литература. Ссылку нашёл на клочке бумаги, лежавшем на скамейке.

И тогда uTorrent не подключается к пирам и не качает). Эффект и симптомы. Array У нас низкая цена на в Москве. Hydra или «Гидра» крупнейший российский даркнет-рынок по торговле, крупнейший в мире ресурс по объёму нелегальных операций с криптовалютой. Не исключено, что такая неуемная жажда охватить все и в колоссальных объемах, может вылиться в нечто непредсказуемое и неприятное. Матанга сайт в браузере matanga9webe, matanga рабочее на сегодня 6, на матангу тока, адрес гидры в браузере matanga9webe, матанга вход онион, матанга. Если вы заметили, что с Мега даркнет не приходят деньги, необходимо связаться с представителями службы поддержки, воспользовавшись зашифрованным каналом связи. Интегрированная система шифрования записок Privenote Сортировка товаров и магазинов на основе отзывов и рейтингов. Мега Ростов-на-Дону Ростовская область, Аксай, Аксайский проспект,. Повседневные товары, электроника и тысячи других товаров со скидками, акциями и кешбэком баллами Плюса. На форуме была запрещена продажа оружия и фальшивых документов, также не разрешалось вести разговоры на тему политики. Исходя из данной информации можно сделать вывод, что попасть в нужную нам часть тёмного интернета не очень-то и сложно, всего лишь необходимо найти нужные нам ссылки, которые, кстати, все есть в специальной Википедии черного интернета. И третий способ, наверное, самый распространенный для покупки битков это банковская карта. Уже! Промо. д. Здесь здесь и узнайте, как это сделать легко и быстро. Есть все города нашей необъятной Родины, а именно России, а также все СНГ. Импортеры комплектующих для ноутбуков (матрицы, батареи, клавиатуры, HDD). Отзывы бывают и положительными, я больше скажу, что в девяноста пяти процентов случаев они положительные, потому что у Меге только проверенные, надёжные и четные продавцы.