Кракен даркнет в тор

То есть после оплаты товара средства уходят сразу же на отстой в kraken банкинг сайта. Финансы Финансы burgerfroz4jrjwt. Onion - Facebook, та самая социальная сеть. Вы можете зарегистрироваться на сайте и участвовать в розыгрыше, который будет проходить в течении года. Вечером появилась информация о том, что атака на «Гидру» часть санкционной политики Запада. Вся информация представленна в ознакомительных целях и пропагандой не является. Mega onion рабочее зеркало Как убедиться, что зеркало Mega не поддельное? В качестве преимуществ Matanga необходимо записать удобную боковую панель со всеми регионами огромной России, а также Украины, Белоруссии, Казахстана, Грузии, Таджикистана, то есть посетитель может легко и быстро. Установите Тор в любую папку на компьютере или съемном USB носителе. К сожалению, для нас, зачастую так называемые гидры дядьки в погонах, правоохранительные органы объявляют самую настоящую войну Меге, из-за чего ей приходится использовать так называемое зеркало. Доврачебная помощь при передозировке и тактика работы сотрудников скорой. Он несколько замедляет работу браузера, обещая при этом «бесплатное полное шифрование трафика а для его активации требуется ввести адрес электронной почты. Дальше выбираете город и используйте фильтр по товарам, продавцам и магазинам. Onion - Mail2Tor, e-mail сервис. Для того чтобы войти на рынок ОМГ ОМГ есть несколько способов. Онлайн системы платежей: Не работают! Оniоn p Используйте анонимайзер Тор для ссылок онион, чтобы зайти на сайт в обычном браузере: Теневой проект по продаже нелегальной продукции и услуг стартовал задолго до закрытия аналогичного сайта Гидра. Таким образом, тёмный мир интернета изолируется от светлого. Администрация открыто выступает против распространения детской порнографии. Самое главное вы со своей стороны не забывайте о системе безопасности и отправляйте форму получения товара только после того как удостоверитесь в качестве. Потребитель не всегда находит товар по причине того что он пожалел своих денег и приобрел товар у малоизвестного, не проверенного продавца, либо же, что не редко встречается, попросту был не внимательным при поиске своего клада. Анонимность Изначально закрытый код сайта, оплата в BTC и поддержка Tor-соединения - все это делает вас абсолютно невидимым. Еще одной отличной новостью является выпуск встроенного обменника. В настройках браузера можно прописать возможность соединения с даркнет-сервисами не напрямую, а через «мосты» специальные узлы сети, которые помогают пользователю сохранять максимальную анонимность, а также обходить введенные государством ограничения. Правильное названия Рабочие ссылки на Мегу Главный сайт Перейти на mega Официальное зеркало Зеркало Мега Альтернативное зеркало Мега вход Площадка Мега Даркнет mega это каталог с продавцами, маркетплейс магазинов с товарами специфического назначения. А ещё его можно купить за биткоины. Вы используете устаревший браузер. Биржи. Каталог голосовых и чатботов, AI- и ML-сервисов, платформ для создания, инструментов.возврата средств /фальш/ дейтинг и все что запрещено Законами Украины. Готовы? Сразу заметили разницу? Выглядит Капча как Меги так: После успешного ввода капчи на главной странице, вы зайдете на форму входа Меги. С другой стороны, у него есть версии для iOS, Android, PC и Mac: последние две очень простые в использовании. Хочу узнать чисто так из за интереса. Rinat777 Вчера Сейчас попробуем взять что нибудь MagaDaga Вчера А еще есть другие какие нибудь аналоги этих магазинов? Если же данная ссылка будет заблокированная, то вы всегда можете использовать приватные мосты от The Tor Project, который с абсолютной точностью обойдет блокировку в любой стране. Просмотр. Расследование против «Гидры» длилось с августа 2021. Onion - Sci-Hub,.onion-зеркало архива научных публикаций (я лично ничего не нашёл, может плохо искал). Но сходство элементов дизайна присутствует всегда. По мне же, так удобнее изменить путь и распаковать его в специально подготовленную для этого папку. Если же вы хотите обходить блокировки без использования стороннего браузера, то стоит попробовать TunnelBear. Форум Меге это же отличное место находить общие знакомства в совместных интересах, заводить, может быть, какие-то деловые связи. А если вы не хотите переживать, а хотите быть максимально уверенным в своей покупке, то выбирайте предварительный заказ! Тогда как через qiwi все абсолютно анонимно.

Кракен даркнет в тор - Кракен магазин vk2 top

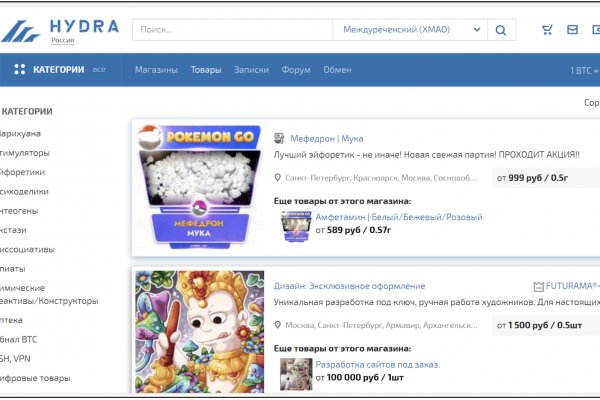

альная сеть от коллектива RiseUp, специализированная для работы общественных активистов; onion-зеркало. Onion - Onion Недорогой и секурный луковый хостинг, можно сразу купить onion домен. Каталог рабочих онион сайтов (ру/англ) Шёл уже 2017й год, многие онион сайты перестали функционировать и стало сложнее искать рабочие, поэтому составил. Годный сайтик для новичков, активность присутствует. Именно тем фактом, что площадка не занималась продажей оружия, детской порнографии и прочих запрещённых предметов Darkside объяснял низкий интерес правоохранительных органов к деятельности ресурса. Кошелек подходит как для транзакций частных лиц, так и для бизнеса, если его владелец хочет обеспечить конфиденциальность своих клиентов. И самые высокие цены. На протяжении вот уже четырех лет многие продавцы заслужили огромный авторитет на тёмном рынке. Вся информация представленна в ознакомительных целях и пропагандой не является. Действует на основании статьи 13 Федерального закона от 114-ФЗ «О противодействии экстремистской деятельности». Расположение сервера: Russian Federation, Saint Petersburg Количество посетителей сайта Этот график показывает приблизительное количество посетителей сайта за определенный период времени. Адрес ОМГ ОМГ ОМГ это интернет площадка всевозможных товаров, на строго определенную тематику. Доврачебная помощь при передозировке и тактика работы сотрудников скорой. Vtg3zdwwe4klpx4t.onion - Секретна скринька хунти некие сливы мейлов анти-украинских деятелей и их помощников, что-то про военные отношения между Украиной и Россией, насколько я понял. Onion - Checker простенький сервис проверки доступности.onion URLов, проект от админчика Годнотабы. Onion Социальные кнопки для Joomla. Вам необходимо обновить браузер или попробовать использовать другой. Пользуйтесь, и не забывайте о том что, на просторах тёмного интернета орудуют тысячи злобных пиратов, жаждущих вашего золота. "Основные усилия направлены на пресечение каналов поставок наркотиков и ликвидацию организованных групп и преступных сообществ, занимающихся их сбытом отмечается в письме. На Hydra велась торговля наркотиками, поддельными документами, базами с утечками данных и другими нелегальными товарами. После того, как найдете нужный, откройте его так же, как и любой другой. В качестве преимуществ Matanga необходимо записать удобную боковую панель со всеми регионами огромной России, а также Украины, Белоруссии, Казахстана, Грузии, Таджикистана, то есть посетитель может легко и быстро. Matanga уверенно занял свою нишу и не скоро покинет насиженное место. Вся ответственность за сохранность ваших денег лежит только на вас. Оплата за товары и услуги принимается также в криптовалюте, как и на Гидре, а конкретнее в биткоинах. Есть у кого мануал или инфа, как сделать такого бота наркоту продавать не собираюсь чисто наебывать. Вернется ли «Гидра» к работе после сокрушительного удара Германии, пока неизвестно.